Puerto Rico vs Dubai: The Ultimate Tax Haven Showdown for U.S. Entrepreneurs

What if the ultimate tax haven for U.S. entrepreneurs wasn’t halfway across the world

but just a short flight from Miami?

As the global elite rush to protect and multiply their wealth, two destinations dominate the conversation: Dubai and Puerto Rico. One promises futuristic towers and a no-income-tax allure in the Middle East. The other? A U.S. jurisdiction with 0% capital gains, 4% corporate tax, and an oceanfront lifestyle that rivals the South of France, all under Puerto Rico’s Act 60.

For founders, traders, digital nomads, and investors tired of flying 14 hours to bank or file taxes, the choice is becoming increasingly clear.

As the global elite rush to protect their wealth, two names dominate the conversation: Dubai and Puerto Rico. One offers futuristic skyscrapers and desert luxury. The other? Zero percent capital gains, beachfront penthouses, and access to America’s financial system, all under Act 60.

But for U.S.-based founders, investors, and crypto millionaires, the choice is becoming increasingly clear.

Why Puerto Rico is Winning Over U.S. Entrepreneurs

1. It’s Still the United States

No need to renounce your citizenship. No complicated offshore compliance headaches. Puerto Rico is a U.S. territory, which means:

You keep your U.S. passport

You file a simpler tax return (no need for FATCA / FBAR complexities)

You get the benefits of the U.S. legal and financial system

2. 0% Capital Gains Tax Under Act 60

For investors and crypto traders, this is the holy grail.

If you qualify under Puerto Rico’s Act 60 program (formerly Act 22), your gains from stocks, crypto, real estate flips, and certain assets are 100% tax-exempt as long as they were acquired after becoming a resident.

3. Only 4% Corporate Tax (Export Services)

If you run a service-based business, consulting, media, finance, marketing, SaaS, investment funds, and more, you can qualify for the Act 60 “Export Services” decree and pay just 4% corporate tax on income earned from clients outside of Puerto Rico.

It’s the most powerful, legal tax incentive available to U.S. citizens. And it’s in your own backyard.

4. You Can Actually Live Here

Let’s be honest, Dubai isn’t for everyone. The time zone, the summer heat, the distance from the U.S., it all adds up. In contrast, Puerto Rico offers year-round tropical weather, direct flights to major cities, and a vibrant, growing Act 60 community of entrepreneurs, investors, and creatives.

Whether you want to live in a beachfront penthouse in Condado, a resort villa in Dorado Beach, or a jungle retreat near El Yunque,

Puerto Rico offers an unmatched lifestyle that blends business and luxury seamlessly.

Why Now?

Over the last three years, Puerto Rico has quietly become the ultimate wealth migration hotspot for U.S.-based founders. Major tax advisory firms, financial planners, and real estate professionals are now catering exclusively to this new class of Act 60 residents.

If you’re a U.S. entrepreneur earning 6–7 figures annually, and you’re ready to turn your income into lasting wealth, Puerto Rico isn’t just an option, it’s a strategy.

How Much Can You Actually Save?

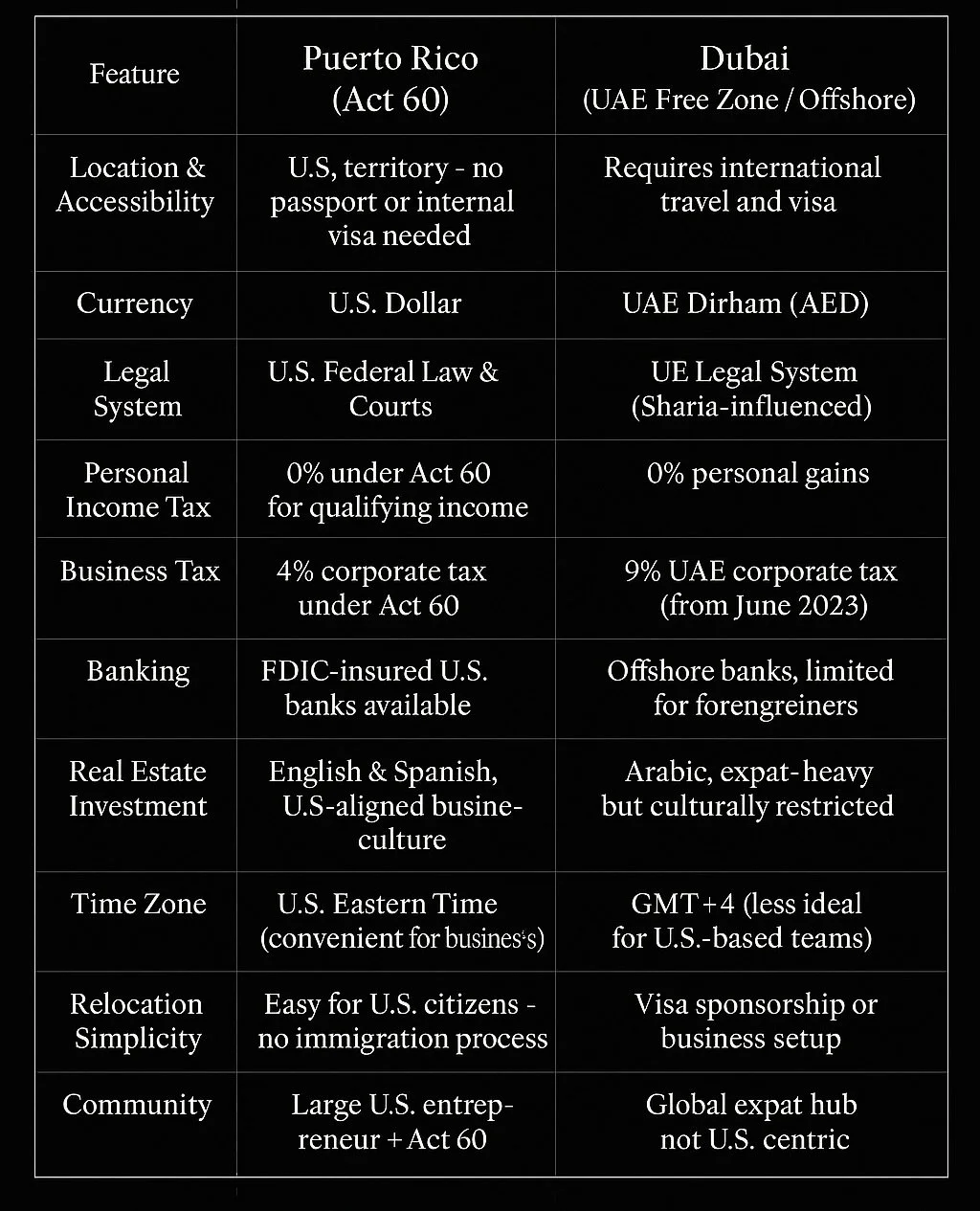

Here’s how Puerto Rico compares to other tax-friendly destinations:

Want to Explore Relocating to Puerto Rico Under Act 60?

At WoodsLux, we specialize in helping founders, investors, and families relocate to Puerto Rico in style, from finding the perfect property, to connecting you with trusted tax advisors, attorneys, relocation experts, and concierge lifestyle services.

→ Download our free relocation guide: Puerto Rico Tax Haven: Strategic Relocation Guide

→ Or Schedule your private relocation call

You’re not just moving to an island.

You’re designing a new chapter of your legacy.

Welcome to Puerto Rico. Welcome to WoodsLux.